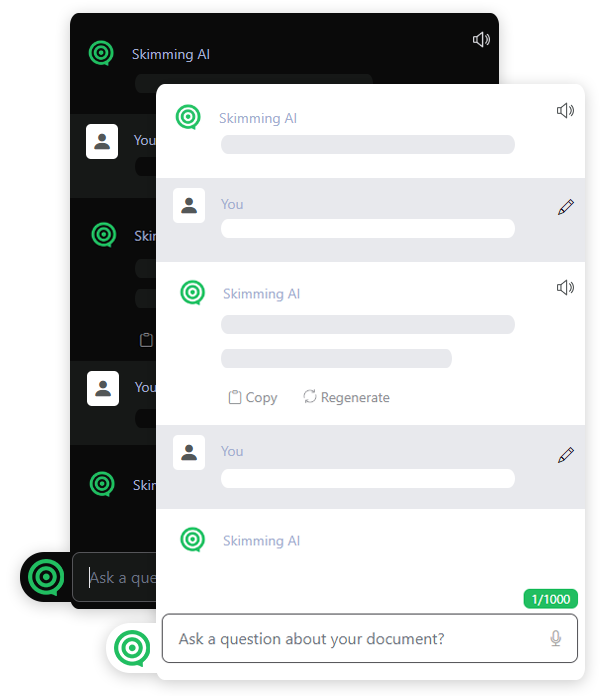

Chat with Document

Want to ask questions, get answers, and instantly extract insights from long documents? Congratulations on finding the best AI document analysis tool that allows you to chat with documents in real-time.

Chat with Documents

Instantly summarize & ask questions about any document uploaded.

Chat With YouTube

Get quick YouTube video summaries and ask insightful questions.

Chat With Website

Summarize entire websites and get specific answers to your queries.

Chat With Audio

Convert audio to text summaries and ask relevant questions quickly.

Chat With Video

Summarize video content and experience real-time interaction through questions.

Chat With Images

Analyze and summarize images, then ask detailed questions for clarity.

New

YouTube Summarizer

Extract key points from YouTube videos & get concise summaries.

PDF Summarizer

Upload a PDF and receive a clear, detailed summary in seconds.

Word Summarizer

Generate accurate summaries from Word documents & capture essential insights.

PPT Summarizer

Transform PowerPoint slides into comprehensive summaries for better understanding.

Text Summarizer

Convert long text into brief summaries with a simple click.

Book Summarizer

Break down lengthy books into quick summaries for easy reading.

Article Summarizer

Summarize articles into quick summaries while keeping the core message intact.

Website Summarizer

Quickly summarize entire websites, get essential insights and relevant details effortlessly.

Image Summarizer

Extract information from images & create concise summaries.

Video Summarizer

Turn long videos into informative summaries for quicker understanding.

Audio Summarizer

Convert lengthy audio files into concise & easy-to-read text summaries.

Podcast Summarizer

Summarize podcasts quickly and catch key points without listening to full episodes.

New

Skim Smarter With our Chrome Extension

New

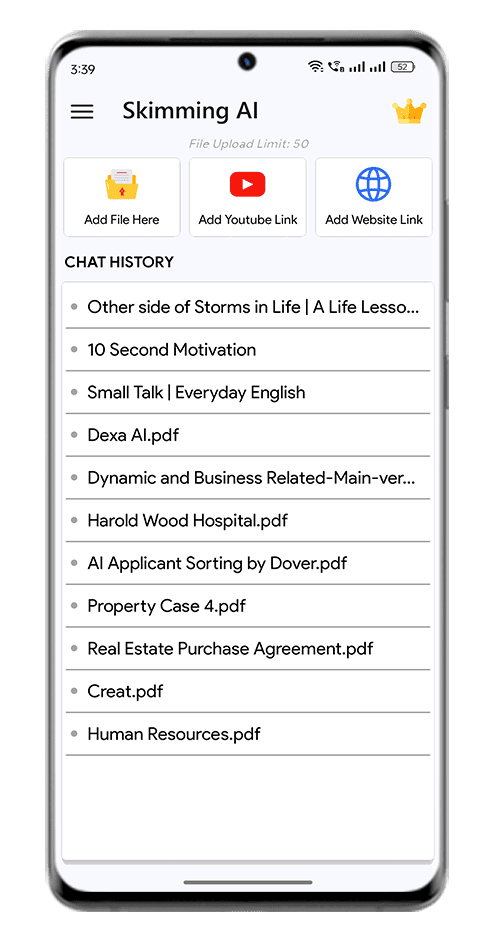

Make Life Easier with an Android App

Our exclusive lifetime deal is now available on AppSumo. Grab it today and supercharge your productivity!

Grab the Deal on AppSumo 🚀

Tired of wasting hours skimming through endless text? Let Skimming AI do it for you! Our free AI-powered tool for document automation can help you cut through the clutter and get the key points of various data types, including documents, audio, video, and text. Sounds exciting? Then give Skimming AI a try and say goodbye to scrolling, long watch time, and tedious listening—get fast and accurate information in no time with this free tool.

Get to the good stuff without ever leaving your browser! With Chrome extension, you can skim any webpage with just a click.

Personalize your experience by creating custom categories for better organization and fast information retrieval

Skimming AI speaks your language! Access information in multiple languages quickly, breaking down language barriers for global users.

Chat directly with your content—ask questions, get answers, and retrieve crucial information effortlessly using tools like chat with YouTube videos or chat with PDFs.

Skip the endless scrolling, watching, and listening. This free tool delivers key insights in seconds with text summarizer capabilities. Whether you need to chat with documents or videos, we’ve got you covered.

Whether it's a document, video, audio, or website, Skimming AI handles it all, giving you instant access to the most critical points using AI for document analysis and document automation.

Available in multiple languages, Skimming AI breaks language barriers, making it accessible to users worldwide.

Why spend long hours when you can get essential information in a snap? Skimming AI's Android app simplifies data extraction, allowing you to interact directly with documents, audio, and videos from your phone. So, why lagging over the information? Stay ahead of the curve, get quick insights, and make informed decisions faster than ever.

Umar Abdullah

Student at Virtual University

"I used Skimming as my study assistant during my exams, and it helped me a lot. I gave it my class notes as PDF, and it made a bunch of good multiple-choice questions for me. About 80% of my exam questions came from these, and it really helped me do well in my studies."

Toni

HR

"Skimming AI has revolutionized my HR role with over 400 employees. Paperwork and data privacy were big issues, but Skimming simplifies document management, making data handling efficient and secure. I'm thrilled with the results."

Josmel Pacheco Mendoza

Bibliometrics researcher, professor at ALFIN.

"Skimming is a very important tool in supporting scientific writing, as it allows me to synthesize information and locate information within a PDF. Thanks to Skimming I can more efficiently understand downloaded articles. Also, now that most things are on video, it allows me to ask questions about something mentioned in the video."

Tejaswini Gopalaswamy

sivi.ai

"I tried the Skimming AI to summarize the Future of Work Document, quite ironic but I must admit, I liked what I saw. Here are my top 3 likes: 1. I liked that I was able to converse and easily find the answers."

Stepan Cherkasov

Aiding novice crypto investors

"Having a tool like ChatGPT and having interactive conversations with documents is amazing. Great work."

Alessandro Valentini

Marketing Lead @ Qudo

"It works extremely well, including uploading a document made of tables. Skimming is able to interpret the data and analyze it! Considering that it's not even fine-tuned for that, it's amazing!"

Haven’t got your answer? Contact our support now

What kind of documents can I ask questions to?

You can ask questions to PDF, DOCX, TXT, CSV Files at the moment.

Where are my documents stored? Are they securely stored?

Yes, your documents are securely hosted on Amazon Web Services S3 (secure encrypted cloud storage from Amazon) with tight rules.

How accurate is the AI in providing answers?

Our AI-powered tool provides accurate answers to your questions by analyzing the PDF, DOC, TXT or CSV document you upload. We are constantly improving our software to ensure the highest level of accuracy. The more specific your questions, the more accurate the answer will be.

How long does it take to receive answers?

You can expect answers within seconds of submitting your questions, but during periods of high demand, response times may be slower. Try our free trial to see if Skimming is the right fit for you.

Is it possible to look for particular information within the imported documents using Skimming?

Absolutely, with Skimming's AI technology, you can easily search for specific information within your documents by asking questions. Our system will quickly scan the documents for answers and provide you with relevant references and page numbers, along with a clear answer in most cases.

Is there a limit to the number of documents I can upload at once?

While there are no strict limits on the number of documents you can upload, we recommend not uploading too many documents at once to ensure timely processing.

Is there a limit to the number of questions I can ask?

The limits depend on the pricing plan you choose. You have 5 questions for free (no credit card needed). Our Basic plan lets you ask 500 questions per day, and the Professional plan allows 1000 questions per day.

Do you offer annual plans?

We are offering an annual plan. 10% off on yearly plan on whole pricing packages.

Quickly get YouTube Summaries , PDF Summaries, Article Summaries, PPT Summaries, Image Summaries, and more. Easily grasp complex content.

Start Uploading Your Documents / YouTube Link